3 Types of Real Estate Markets - Conditions, and Trends That Shape Home Prices

The Different Types of Real Estate Markets Real estate isn’t defined by a single “good” or “bad” moment. Instead, the market moves through cycles shaped by supply, demand, economic conditions, and buyer sentiment. Whether you're buying, selling, or simply staying informed, understanding these market

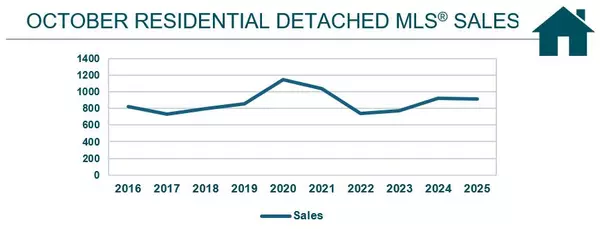

Real Estate Market Statistics Around Winnipeg and Surrounding Areas for October 2025

Winnipeg Real Estate Market Update – October 2025 The Winnipeg Regional Real Estate Board’s October 2025 report provides a snapshot of steady growth in property values, modest sales activity, and regionally varied trends across housing types.While overall prices and dollar volume continue to rise, s

Types of Home Wiring - How to Identify Old, Dangerous, and Safe Electrical Systems

Types of Home Wiring - What’s Safe, What’s Dangerous and How to Identify When it comes to home safety, one thing that is important and often overlooked is your electrical wiring. Whether you’re buying an older home, renovating, or just curious about what’s behind your walls, understanding the differ

Tara Zacharias

Phone:+1(204) 293-0933