Building a custom new home in Winnipeg

What to Know Before Building a New Home in Winnipeg

Building a new home is an exciting experience. It’s a chance to enjoy modern designs, new materials, and cutting-edge construction techniques. For this post, “new home” refers to any home purchased directly from a builder. This could include infills (new builds in established neighborhoods), show homes or spec homes (already built and listed for sale), or homes that are yet to be constructed with your favourite custom home builder.

Over the years, new homes have become increasingly popular, and it’s easy to see why. Many buyers are drawn to the idea of moving into a home that’s never been lived in, featuring family-friendly layouts and modern amenities. However, buying a new home isn’t the same as purchasing a resale property, and there are some important things you need to consider before jumping in.

A New Home – or an Existing One?

Overview

- 25% of homes purchased annually are newly built, 75% are resale homes.

- Consider your family’s needs when deciding, whether new or resale.

- Renovators can help if you choose a resale home.

Advantages of Buying a New Home

CHOICE: Choose Your Builder

- Select your builder based on their reputation and track record.

- Professional builders are skilled, experienced, and committed to your satisfaction.

- Each custom home builder has their own unique style and materials used.

COMFORT: Up-to-Date Construction

- New homes meet stringent building codes for energy efficiency, safety, and performance.

- Higher quality construction materials and systems ensure long-term satisfaction.

COMMUNITY: Well-Designed Developments

- New neighborhoods are designed to foster a sense of community.

- Features include green spaces, playgrounds, and safe roads and pathways.

- Most of the developing communities have commercial and recreational amenities close by.

- Schools and access to major roadways are considered for the development.

- Each builder has a number of lots available for you too choose from, deciding which community you want to live in and the size of the lot you require for your custom build is a priority.

CONFIDENCE: Know What You’re Getting

- No worries about future repairs or maintenance for many years.

- Unlike resale homes where repairs are uncertain, new homes come with a warranty and after-sales service programs from builders.

PERSONALIZATION: Customize Your Home, Choose Your Lot

- Choose floor plans, finishes, and features to make your new home a fresh and functional custom space.

- New homes offer modern, open layouts with ample natural light and well-planned workspaces.

- The lot you choose from your builder, will determine your view and the space available for landscaping/recreation.

Choosing a Builder is as Important as Choosing a Home

When buying a new home, you’re not just selecting a layout or a lot—you’re choosing the builder. Each builder has their own construction methods, materials, and customer service approach. Research is key. Look into builders’ reputations, reviews, and past projects to ensure you’re working with someone reliable. Your builder should not only meet your quality expectations but also be willing to collaborate with you on personalizing your new home.

Having your builder affiliated with either the Canadian Home Builders' Association and/or Manitoba Homebuilders Association will ensure building and material quality, safety, employment and energy efficiency standards.

Questions to Discuss with Your Builder

-

What third-party warranty providor are you a member with?

-

Which areas of the city do you primarily build in?

-

Are there any Show Homes available for us to tour?

-

Can you meet our design requirements while staying within our budget?

-

When can construction start, and what is the estimated timeline for completion?

-

How do you handle changes or adjustments during the construction process?

Steps to Building Your New Home

-

Arrange Your Mortgage

-

Compare interest rates and services from different lenders.

-

Consider your past history with the institution and online banking options.

-

Evaluate loan details like lending rates, amortization, and insurance.

-

- Choose your Community - Choose the area of the city which you will make your new neighborhood

-

Establish a Relationship with Your Builder

-

Begin negotiations with a focus on maintaining positive communication.

-

Understand the builder’s methods, materials, and team.

-

Ask questions about their standards and practices.

The Altima - Model Home / Source: Daytona Homes

-

-

Choose the Right Home

-

Be clear on your desired design, functionality, and layout.

- Explore the builders' design centres to choose your interior finishes

- Visit model Show Homes to view the craftsmanship in person

-

Involve all household members in the decision.

-

Consider future needs like family expansion and explore features such as:

-

Number and size of bedrooms and bathrooms

-

Storage, garages, fireplaces, or extra rooms

-

Environmentally friendly materials

-

-

-

Make the Purchase

-

Carefully review your contract and clarify any unclear details.

-

Seek legal advice if necessary before signing.

-

Understand payment terms, including deposits and phased payments.

-

Confirm what happens if you need changes after signing.

-

Work with a Real Estate Agent

If you’re considering a custom new build, partnering with a REALTOR® can make all the difference. Agents familiar with new construction understand how different builders operate and can help you navigate the options to find the right match for your needs.

Your REALTOR® is familiar with the developing communities and can help you find the ideal lot in your desired area, with which you can then transform with your custom home build of choice.

Negotiation is Possible

While it’s true custom home builders may be less flexible on the base price of a home, there are plenty of ways to negotiate. Your REALTOR® can help you secure upgrades, appliances, or other incentives that add value without necessarily reducing the price tag.

Often builders may have a reduced price on certain models of homes, which may be made known to the buyer at the time they are choosing their custom home builder.

Understanding Fair Market Value (FMV) and Its Impact on GST Rebates

The impact fee in Winnipeg, was a charge on new home builders and homeowners to help fund infrastructure like libraries, fire halls, roads, and sewers. Calculated at $57.47 per square meter of floor space, the fee applied to residential building permits in developing areas. However, the Manitoba Court of Queen’s Bench ruled the fee was an invalid tax and ordered all collected fees, with interest, to be refunded. In response, the city suspended the fee and announced plans to collaborate with the development industry to create a future alternative.

Warranty on New builds: Key Information for Homebuyers

The province intended to implement The New Home Warranty Act, which would require all builders to secure a warranty on new builds, however it did not happen. Instead, builders are assuring their buyers through affiliations with organizations such as The Manitoba Home Builders Association and The New Home Warranties Program of Manitoba Inc that they are accredited, secure and professional builders who have seeked third party warranty for their valued customer. New home warranty is not mandatory from builders but is secured as an assurance.

What Homes Are Covered?

-

Single-family homes

-

Townhomes, duplexes, and triplexes

-

Condominiums (including common areas)

-

Manufactured homes (modular and ready-to-move)

-

Cottages and recreational homes

What’s Not Covered?

-

Hotels, motels, and lodges

-

Dormitories, personal care homes

-

Mobile homes, RVs, and trailers

-

Rental buildings

-

Habitat for Humanity homes

-

Homes built by Hutterite Colonies on colony land

Third-Party New Home Warranties in Manitoba

Purchasing a newly built home in Manitoba most often comes with added peace of mind through third-party new home warranties. These warranties, provided by independent organizations, protect homeowners from unexpected construction defects and offer coverage that exceeds basic builder guarantees.

What Are Third-Party New Home Warranties?

Third-party new home warranties are insurance-backed programs designed to protect new homeowners against construction issues. In Manitoba, reputable builders often enroll their projects in such programs to provide buyers with security and confidence in their purchase. These warranties are regulated to ensure a minimum standard of protection.

Third-party new home warranties in Manitoba are an essential safeguard for homeowners, ensuring long-term satisfaction with your investment. The most common ways to identify if a builder provides' third-party home warranty are through the following affiliations;

- New Home Warranties Program of Manitoba Inc

- Manitoba Home Builders' Association (MHBA), all builder members carry third-party warranty coverage through Blanket Home warranty, Aviva Home Warranty, New Home Warranty Program of Manitoba and Progressive Home Warranty.

- National Home Warranty.

- Canadian Home Builders Association (CHBA), Builders associated often offer third-partie warranty coverage.

Expect Some Shifting and Settling

It’s not uncommon for new homes to develop small cracks or minor shifts in the first year. This is a natural process as materials settle and adjust to seasonal changes. Most builders offer a one-year follow-up to address these issues, so make sure you understand what’s included in your warranty.

New homes in Manitoba typically come with a 1-2-5-10 year warranty and the builders can tailor these warranties for individual projects, so review the terms and coverage carefully to know exactly what’s included.

Coverage Highlights often Include,

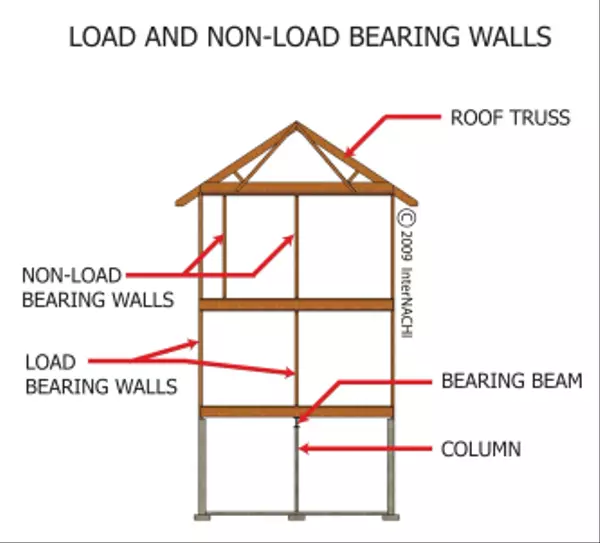

- Structural Defects: Covers major structural components of the home, such as the foundation and framing, typically for up to 10 years.

- Workmanship and Materials: Addresses defects in materials or labor, such as plumbing, electrical, or heating systems, exterior cladding, windows and doors usually for the first 1-2 years. Manitoba Building Code Violations, 2 years.

- Water Penetration: Provides coverage for leaks or water damage caused by defects, often for 2-5 years.

- Defects in Design: Material damage as a result of, typically 5 years.

- Deposits and Delays: Protects buyers’ deposits and compensates for delays in closing due to builder-related issues.

Benefits of Third-Party Warranties

- Peace of Mind: Homeowners are protected against costly repairs and unforeseen issues.

- Resale Value: A warranty can be transferred to new owners, making the property more attractive to buyers.

- Builder Accountability: Builders enrolled in these programs are held to high standards, ensuring quality craftsmanship.

How to Verify Warranty Coverage

- Ensure your builder is registered with a third-party warranty provider.

- Request a copy of the warranty details before closing.

- Understand the terms, exclusions, and steps to file a claim if needed.

How Does the Warranty Work?

-

Who Provides It? Third-party warranty providers work with your builder to offer coverage.

-

Who Arranges It? Builders handle warranty registration. Homebuyers don’t need to contact warranty providers.

-

What If There’s an Issue?

-

Contact your builder first to resolve any defects.

-

If the builder is unavailable or cannot resolve the issue, file a claim with the warranty provider.

-

What Happens If You Sell Your Home?

- Warranty Stays with the Home: The remaining warranty coverage automatically transfers to the new homeowner—no extra steps required.

- A Selling Feature: Highlighting this coverage can make your property more appealing to buyers.

- Recommendation: Provide the warranty certificate to the new homeowners during the sale.

What If the Builder Closes or Leaves the Program?

- Warranty Remains Active: Once your home is registered and a Possession Certificate is issued, the warranty stays valid.

- Repairs by the Program: If the builder cannot make repairs, the warranty provider will step in to address issues covered under the warranty terms.

Be Prepared in the case of a Delay

Construction timelines can be unpredictable, so possession dates are often more of a target than a guarantee. If you’re selling your current home or moving from a rental, make sure you have a backup plan in case of delays.

Additional Costs to Plan For

Building or buying a new home often comes with extra expenses beyond the listed price. Some common costs include:

- Appliances and Air Conditioning: These aren’t always included unless the builder offers them as part of a promotion.

- Upgrades: Base prices often exclude upgrades like higher-end finishes or custom features. Budget for these additional costs.

- Optional Costs: Landscaping, fencing, deck construction, and basement finishing are typically left to the homeowner.

- Price Escalation Clauses: If construction takes over a year, some builders may pass on rising material costs to buyers.

- Possession and Moving: Plan for unexpected expenses like landscaping deposits and final meter readings for utilities when you move.

- Property Taxes: Until the city assesses the full property value, you’ll only pay taxes on the land value. Once assessed, a retroactive adjustment may be required.

Final Thoughts

Buying a new home can be an incredible opportunity to tailor a house to your preferences and enjoy the perks of modern living.

If you’re considering a new home in Winnipeg, I can help you navigate the process and protect your interests every step of the way. Let’s connect to find the right builder, home, and strategy for your needs!

Categories

Recent Posts

Leave a Reply

REALTOR®Thanks for stopping by and taking the time to get to know me!I'm Tara Zacharias, a real estate salesperson and licensed REALTOR® located in the vibrant city of Winnipeg. Real estate and all that's associated with it such as, interior design, construction, community planning, marketing or the financial aspect, all fascinate me. I take pride in working with my clients to find their ideal home, sell their property for the best value and make smart investment decisions.Born in Manitoba, I'm familiar with the prairie life in both the City of Winnipeg or in a rural town, i've lived both. My interests are hiking, riding bicycle, theatre, making art, concerts and trying new restaurants. I have a Bachelor of Fine Arts in drawing and painting and a Post-Graduate Certificate in sculpture and installation from OCAD University.Whether you're a first-time homebuyer, a seasoned seller or an investor looking for opportunities, I'm here to guide you every step of the way with integrity, expertise, and a genuine desire to see you succeed in your real estate journey. My mission is to make sure your wants and needs are met so that we can work together again to make your real estate dreams a reality.+1(204) 293-0933 tara@tarazacharias.com

REALTOR®Thanks for stopping by and taking the time to get to know me!I'm Tara Zacharias, a real estate salesperson and licensed REALTOR® located in the vibrant city of Winnipeg. Real estate and all that's associated with it such as, interior design, construction, community planning, marketing or the financial aspect, all fascinate me. I take pride in working with my clients to find their ideal home, sell their property for the best value and make smart investment decisions.Born in Manitoba, I'm familiar with the prairie life in both the City of Winnipeg or in a rural town, i've lived both. My interests are hiking, riding bicycle, theatre, making art, concerts and trying new restaurants. I have a Bachelor of Fine Arts in drawing and painting and a Post-Graduate Certificate in sculpture and installation from OCAD University.Whether you're a first-time homebuyer, a seasoned seller or an investor looking for opportunities, I'm here to guide you every step of the way with integrity, expertise, and a genuine desire to see you succeed in your real estate journey. My mission is to make sure your wants and needs are met so that we can work together again to make your real estate dreams a reality.+1(204) 293-0933 tara@tarazacharias.com330 St Mary Ave, Winnipeg, MB, R3C 3Z5, CAN

https://tarazacharias.com/