Preparing to Become a First Time Home Buyer - 9 Essential Steps

As a first-time homebuyer you will be excited with this new milestone that comes with plenty of planning and preparation. Here’s what you need to know to make the most of your home-buying experience:

1. Understand Your Budget

- Calculate Your Affordability: Start by assessing your income, debts, and living expenses to figure out how much you can comfortably afford for home expense. Many first-time buyers use the "28/36 rule" as a guide, meaning that your mortgage payment should not exceed 28% of your monthly gross income, and total monthly debts should stay under 36%.

- Factor in Additional Costs: Beyond the down payment, remember to budget for closing costs, land transfer tax, property taxes, insurance, maintenance, and utilities.

2. Check Your Credit Score

- Know Your Score: Lenders will look at your credit score to determine your mortgage eligibility and interest rate. A good credit score opens up better rates and a more flexible term, making your mortgage more affordable.

- Improve Your Score if Needed: If your score could use a boost, focus on paying down debts, avoiding new credit inquiries, and paying bills on time to increase your score before applying. Budget for purchases that will require a loan or use of credit of any size after you have secured the purchase of your home. Your credit must remain the same from the time of pre-approval to the time of securing the mortage for your purchase.

3. Get Pre-Approved for a Mortgage

- Why Get Pre-Approved? A mortgage pre-approval gives you a clear budget range, so you can shop for homes with confidence. It also shows sellers you’re a serious buyer, which can be beneficial when making an offer in a competitive market.

- Shop Around: Look at different lenders and mortgage options to find the best fit for you. The rates and terms can vary, so it’s worth the extra time to find the right mortgage.

4. Research First-Time Buyer Programs

- Government Incentives: In Canada, first-time buyers can access the Home Buyers’ Plan, which allows you to withdraw from your RRSP for a down payment. You can also open a First Home Savings Account (FHSA) at your bank that allows you to make contributions to save for your first home that will be tax-deductible, similar to a registered retirement savings plan (RRSP). The First-Time Home Buyer Incentive is no longer offered.

- Tax Credits and Rebates: Programs like the Home Buyers’ Tax Credit (HBTC) and GST/HST New Housing Rebate can help lower your tax burden.

5.Prioritize What you Need In a Home

- Create a Wish List: Identify your must-haves (like a certain number of bedrooms or proximity to work) versus nice-to-haves (like a big backyard or a specific style of home). This list can guide you through your search and help you stay focused.

- Consider Future Needs: Think long-term when buying. For instance, if you’re planning to expand your family, choose a property that can accommodate your future plans.

6. Work with a Licensed REALTOR®

- Why It Helps: Your REALTOR® knows the local market, negotiates on your behalf, and guides you through the buying process. They can help you find the best home for your budget, and their experience can make the process smoother.

- Ask Questions: Make sure you understand the terms, conditions, and all the steps involved in your purchase. Your agent should be someone you feel comfortable communicating with.

7. Research Neighborhoods

- Explore the Area: Visit neighborhoods at different times of the day, check out local amenities, and speak with residents if possible. This gives you a sense of the community and whether it’s a good fit for you.

- Consider the Commute: Make sure the location works with your daily commute and lifestyle. Proximity to work, schools, and recreational spots can make a big difference in your day-to-day life.

- Proximity to Essentials: Schools, hospitals, grocery stores, and public transport are key amenities. Choosing a location with easy access to these essentials can simplify day-to-day life.

- Safety and Community: Research neighborhood safety statistics and crime rates. Some areas have strong community networks, which can be beneficial for social connections and support.

8. Be Prepared for the Closing Process

- Understand Closing Costs: These typically include legal fees, title insurance, land transfer tax and home insurance. Plan for these to be between 1.5% and 4% of the home's purchase price.

- Final Walkthrough: Before you close, take a final walkthrough of the property to ensure everything is in the expected condition.

9. Plan for the Long-Term Costs of Homeownership

- Monthly Maintenance and Utilities: Budget for regular maintenance costs, including repairs, lawn care, and utilities.

- Build an Emergency Fund: Setting aside funds for unexpected repairs (like appliance replacements or roof fixes) can ease the burden if issues arise.

Benefits of Being a First-Time Homebuyer

- Building Equity: Each mortgage payment you make builds your equity—a form of savings that can increase as your property value grows.

- Stability and Security: Homeownership means more control over your living space, no rent hikes, and a sense of permanency.

- Personalization: You have the freedom to renovate and make your space truly yours.

- Tax Benefits: Some programs and tax credits are specifically for first-time buyers, helping you reduce your upfront and ongoing costs.

Being a first-time buyer is both thrilling and challenging. With the right preparation and a good team on your side, you can make informed decisions, enjoy the journey, and find a home that fits your needs and goals.

Research The Market

Researching the real estate market thoroughly can help you make confident decisions and find a property that meets your needs and budget. Here’s a recommended approach to market research for first-time homebuyers:

Use Online Tools to Analyze Listings and Pricing Trends

- Online Listings: Websites like Realtor.ca provide detailed listings with price comparisons, property photos, and neighborhood info. Review listings to get a sense of the types and prices of homes available.

- Check Market Statistics: Look at data like average home prices, price trends over recent months, and sales-to-list ratios (the percentage of listed homes that have sold). This helps you gage demand and understand price movement.

Visit Open Houses

- Observe the Property: Visiting open houses provides a feel for the space, the quality of materials, and the property layout. Take notes on what appeals to you and what doesn't.

- Ask Questions: Open houses are a chance to ask questions about the home and area, including any upcoming developments that may impact property values.

- Explore Multiple Listings: By seeing several homes, you’ll start to notice trends in pricing and value, helping you better recognize a good deal.

Consult a Real Estate Professional

- Speak to a Local Agent: A licensed REALTOR® offers insights that online research can’t. They can inform you about neighborhood trends, point out areas with potential for growth, and give an insider perspective on market dynamics.

- Gather Professional Advice: From mortgage brokers to home inspectors, consult professionals who can guide you through financing, property conditions, and help you understand the value and potential of each home.

Analyze Market Trends

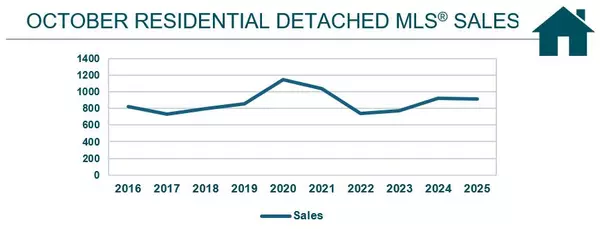

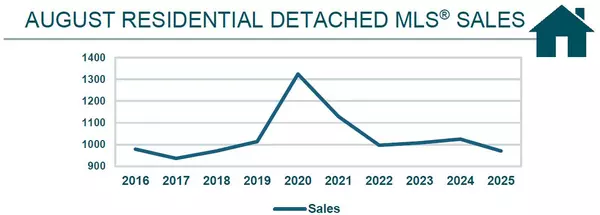

- Average Home Prices and Sales Rates: Look at the average price of homes over the past 6-12 months to identify if prices are rising or stabilizing. This gives you an idea of whether it’s a buyer’s or seller’s market.

- Seller's Market: The demand for homes exceeds the available inventory. This gives sellers a stronger position in negotiations since multiple buyers are often competing for the same property. A rise in home prices, faster sales and more as-is terms are characteristic of a seller's market.

- Buyer's Market: The supply of homes for sale exceeds buyer demand. This market dynamic generally benefits buyers, as they have more options and greater negotiating power. Lower home prices, longer listing times and more willingness to negotiate from the sellers are characteristic of the buyer's market.

- Days on Market (DOM): Homes that sell quickly indicate high demand, while homes that stay on the market longer may provide more room for negotiation. DOM statistics help determine the level of competition you may face.

- New Listings and Inventory Levels: Tracking the number of new listings can signal whether inventory is increasing or decreasing. More inventory can mean more choice and potentially more negotiating power.

Stay Updated on Interest Rates and Mortgage Trends

- Monitor Mortgage Rates: Mortgage rates directly impact your monthly payments and overall budget. As interest rates fluctuate, they affect affordability and may determine the best time to buy.

- Evaluate Financing Options: Speak with your lendor or a mortgage broker to understand the types of mortgages available, including fixed vs. variable rates, as this could influence your buying strategy.

Pay Attention to Seasonal Patterns

- Market Cycles: Real estate activity often peaks in spring and summer, while it slows down in winter. Buying during a slower season can give you negotiating leverage, while buying during peak times may mean more competition.

Research Local Development Plans

- Future Developments: Check for any new zoning changes, infrastructure projects, or upcoming business developments in your target neighborhoods. These can influence property values and the overall desirability of an area.

- Community Developments: Winnipeg has many communities being developed with the option to purchase a lot and build your home through one of the custom home builders. These builders have spec homes ready to go and show homes for you to purchase or to get the feel of the design styles and materials that are available.

By thoroughly researching the market, analyzing trends, and taking a hands-on approach, you’ll gain valuable insights to make informed decisions. This foundation of knowledge can empower you to move confidently and maximize the benefits of your first home purchase.

Navigating these programs can be easier with guidance from a REALTOR®, financial advisor, or mortgage broker. These professionals can provide insights into which options best fit your needs and help make the home buying process as smooth as possible. For more details, visit CMHC's website for information and program links.

Categories

Recent Posts

Leave a Reply

REALTOR®

REALTOR®I became a REALTOR® because I truly enjoy helping people find the place that feels like home and because providing exceptional service during such an important moment in someone’s life is something I genuinely care about. Supporting sellers as they move on, move up, or move forward is just as meaningful, and being part of that transition is something I’m grateful to contribute to.

I make the buying or selling journey feel organized and approachable with clear communication and practical guidance. With an approach supported by market data, trends, and neighbourhood insights, you'll always understand what’s happening and how to make the most informed decisions.

Whether you’re buying your first home, selling a place filled with memories, or planning your next step, I’m here as someone who listens, shows up, and puts your goals at the centre of every decision. I'm focused on what serves you best.

I'm Tara Zacharias, a real estate salesperson located in the vibrant city of Winnipeg. Thanks for stopping by and taking the time to get to know me!+1(204) 293-0933 tara@tarazacharias.com330 St Mary Ave, Winnipeg, MB, R3C 3Z5, CAN

https://tarazacharias.com/