15+ Hidden Costs of Homeownership - Beyond the Mortgage in Winnipeg

Owning a home in Winnipeg involves more than just paying your mortgage.

While the mortgage is a significant financial commitment, homeownership involves several other costs.

Knowing these additional expenses helps you better plan and avoid financial strain.

Beyond the mortgage, homeowners must budget for property taxes, insurance, utilities, maintenance, and other routine costs that can add up quickly.

Understanding these financial obligations upfront will provide peace of mind and help you enjoy your homeownership experience without surprises.

Here is a comprehensive list of hidden costs of homeownership to consider:

- Property Taxes

- Homeowners Insurance

- Utilities

- Maintenance and Repairs

- Home Security

- Home Improvement and Renovations

- Condo Fees

- Property Management Fees

- Interest Rate Adjustments

- Legal and Administrative Fees

- Property Survey

- Emergency Fund

- New Home Warranty

- Landscaping and Lawn Care

- Appliance Upkeep and Replacement

What are the Hidden Costs of Owning a Home?

Property Taxes

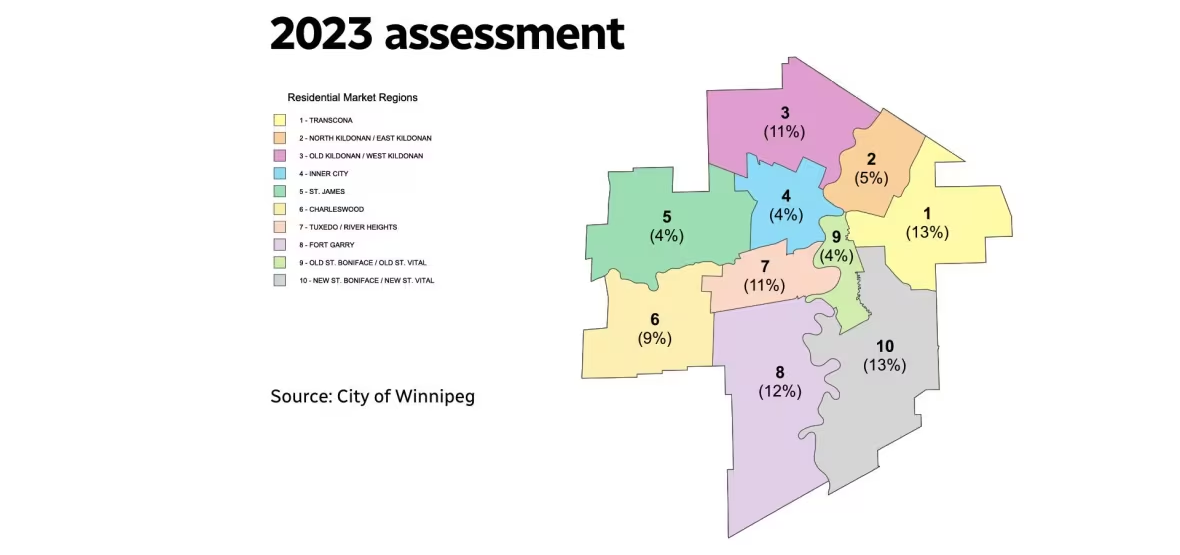

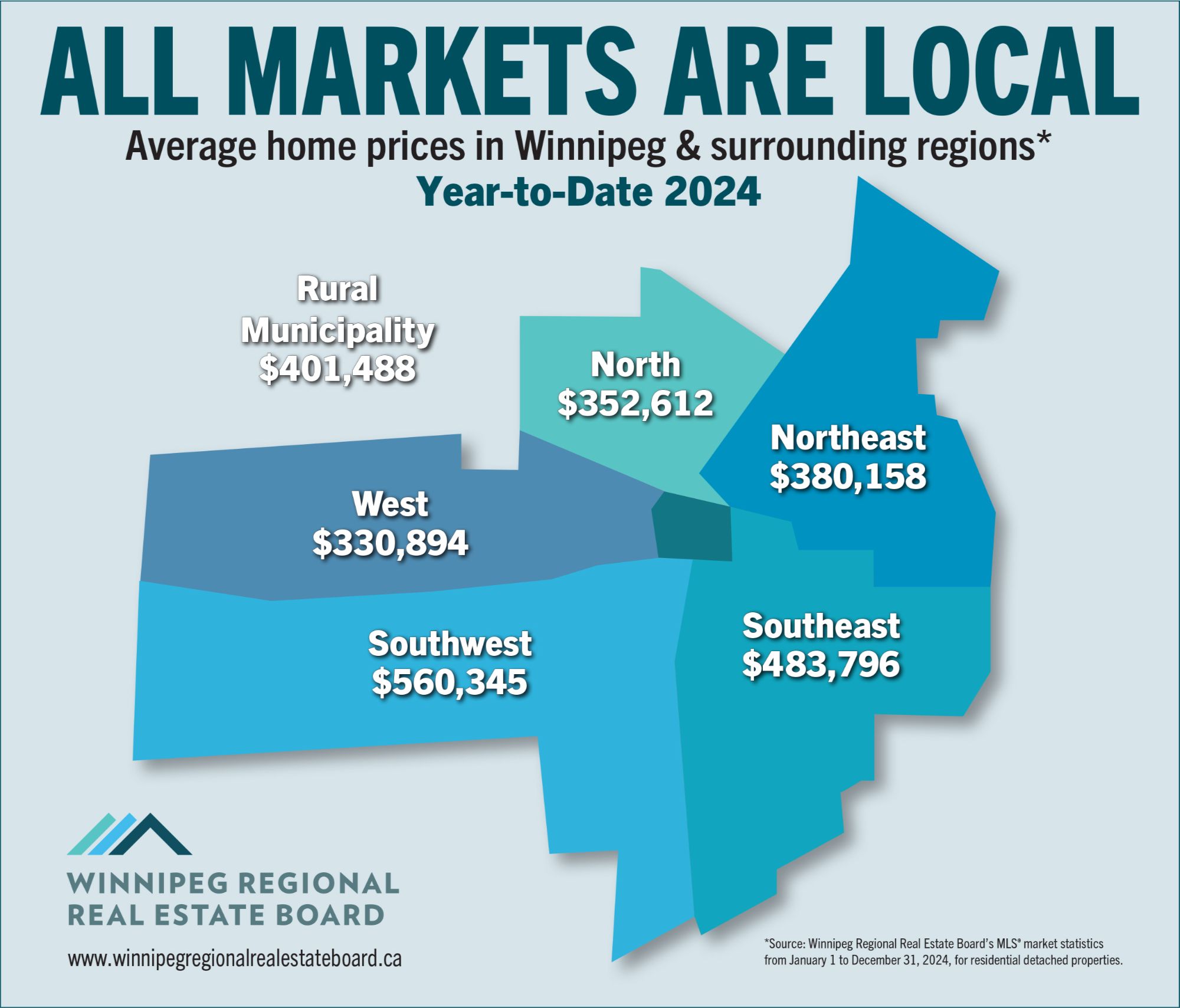

Winnipeg home assessment Map. Source: City of Winnipeg

Owning a home in Winnipeg means paying annual property taxes, which fund local services such as education and road maintenance.

The amount is based on the home’s assessed value and the municipal tax rate, but Winnipeg offers programs like the Tax Instalment Payment Plan (TIPP) to manage this cost.

- Annual Taxes: Homeowners are responsible for paying annual property taxes, which fund local services such as schools, roads, and emergency services. The amount depends on the assessed value of the property and the municipal tax rate. The city of Winnipeg offers the Tax Instalment Payment Plan or TIPP, which offers monthly payments of taxes rather than one lump sum.

- School Taxes: A school division special levy is included on your property tax amount. The Manitoba Government has introduced the Manitoba education property tax credit (EPTC) to homeowners offering a 50% credit directly on their annual property tax bill. This coincides with the school tax rebate of up to 350.00. Both to be replaced in 2025 with the new Homeowners Affordability Tax Credit of up to $1500.00, providing more relief for homeowners and almost eliminating school tax for homes with assessed value of approximately 285,000 and below.

Homeowner’s Insurance

Homeowner’s Insurance is a must for property owners. Source: Winnipeg Insurance Brokers Ltd

Homeowners Insurance protects your home and finances from unexpected disasters and damages. Besides standard home insurance, mortgage insurance and optional life and illness coverage are important considerations for homeowners.

- Home: Home insurance protects against unforeseen damage from events like fire, theft, and natural disasters. Your premium may also cover the contents of your home. Costs vary based on the home's value, location, and coverage level.

- Mortgage: Canada Mortgage Housing Corporation (CMHC) requires insurance on a mortgage with less than 20% down payment. For properties over 1 million this insurance is not available and the 20% down payment is required.

- Life and Illness: While not required, one may want to purchase life insurance to be passed on to your beneficiary. This could be used to pay any remaining balance of your mortgage. Illness insurance is an option to assist you in the case that you are unable to work

Utilities

Photography of Man Repairing Electrical Wires. Source: pexels

Homeownership comes with monthly utility expenses that include energy, water, and natural gas. It’s important to factor these essential costs into your budget as they can vary depending on the size and efficiency of your home.

- Hydro: Electricity bills for lighting, appliances, and heating.

- Water and Sewer: Charges for water consumption and sewer services.

- Gas: Costs for heating, cooking, and possibly water heating if you use natural gas.

Maintenance and Repairs

Man repairing roof. Source: RoofCo

Routine maintenance and unexpected repairs are ongoing responsibilities for homeowners. Preparing for these costs is essential to maintain the condition and safety of your home.

- Routine Maintenance: Regular upkeep like lawn care, snow removal, and cleaning gutters.

- Unexpected Repairs: Costs for repairing or replacing broken appliances, plumbing issues, or roofing problems.

- Preventive and Reactive Services: Costs for routine pest control to prevent or address infestations. Treatment of wood to protect from moisture damage.

Home Security

Home Security in Winnipeg. Source: Telus SmartHome Security

Securing your home is an additional expense that helps protect your investment and family. Homeowners may consider upgrading locks or installing security systems for enhanced safety.

- Locks: You may want to change or rekey the locks on all exterior doors. Consider upgrading the locks for enhanced security. Also, check that all windows have working locks.

- Security System and Surveillance: Consider a monitored or unmonitored security system. Add exterior or interior cameras, motion-activated lighting, or timed lighting.

Home Improvement and Renovations

A renovated kitchen. Source: SunSet Homes

Over time, you may want to update or renovate your home to enhance its value or accommodate your lifestyle. Renovations can be costly, so planning for these projects is important.

- Renovation Costs: Expenses for any upgrades or changes to the home, from cosmetic improvements to major renovations.

- Depreciation: Replacing or repairing major appliances like the furnace, refrigerator, or dishwasher as they wear out.

- Home Value Impact: Well-planned renovations and improvements can increase the resale value of your home, making it a smart long-term investment. Strategic renovations can enhance your property's functionality and market appeal from upgrading kitchens and bathrooms to adding energy-efficient features.

Condo Fees

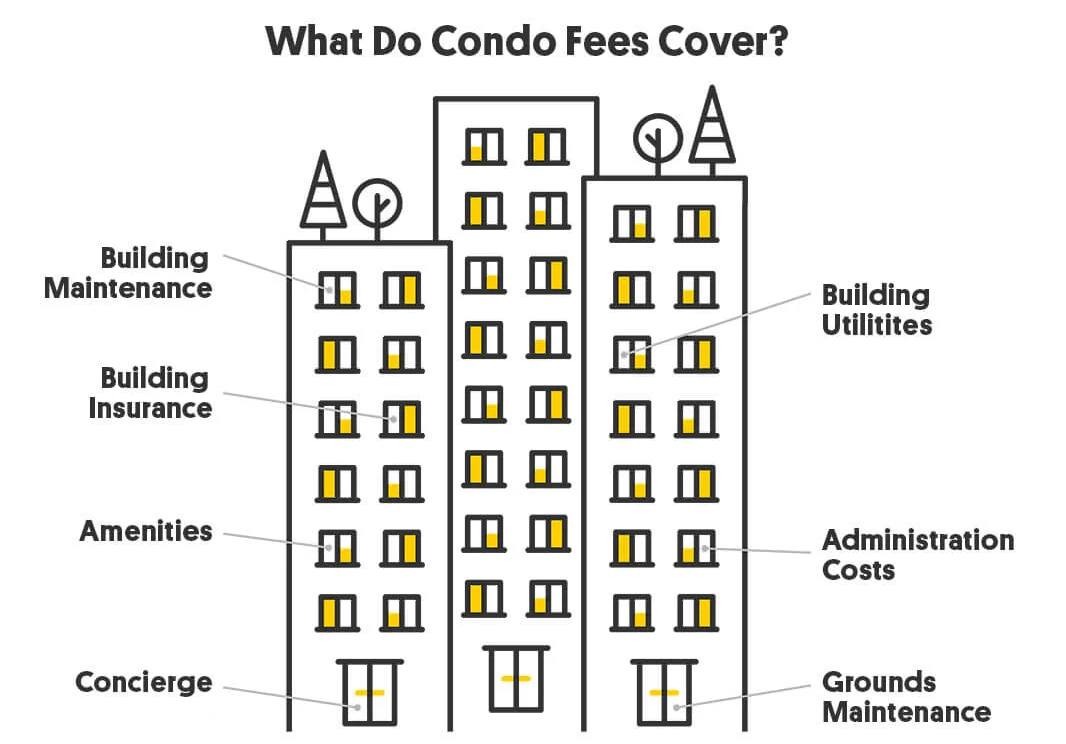

What do Condo Fees Cover?. Source: Tribe

If you live in a condo or certain townhomes, monthly condo fees are an additional cost to budget for. These fees usually cover shared spaces and amenities maintenance and contributions to a reserve fund.

- Monthly Fees: A monthly fee is required for condominiums and townhomes that are not freehold. This fee may cover shared amenities, some utilities, maintenance of common areas, and a contribution to the condo reserve fund.

- Reserve Fund Contributions: Condo fees often include contributions to a reserve fund, which is used for future major repairs or upgrades to shared spaces like roofs, parking areas, or elevators. This ensures that unexpected large expenses are covered without requiring a large special assessment from unit owners.

Property Management Fees (if applicable)

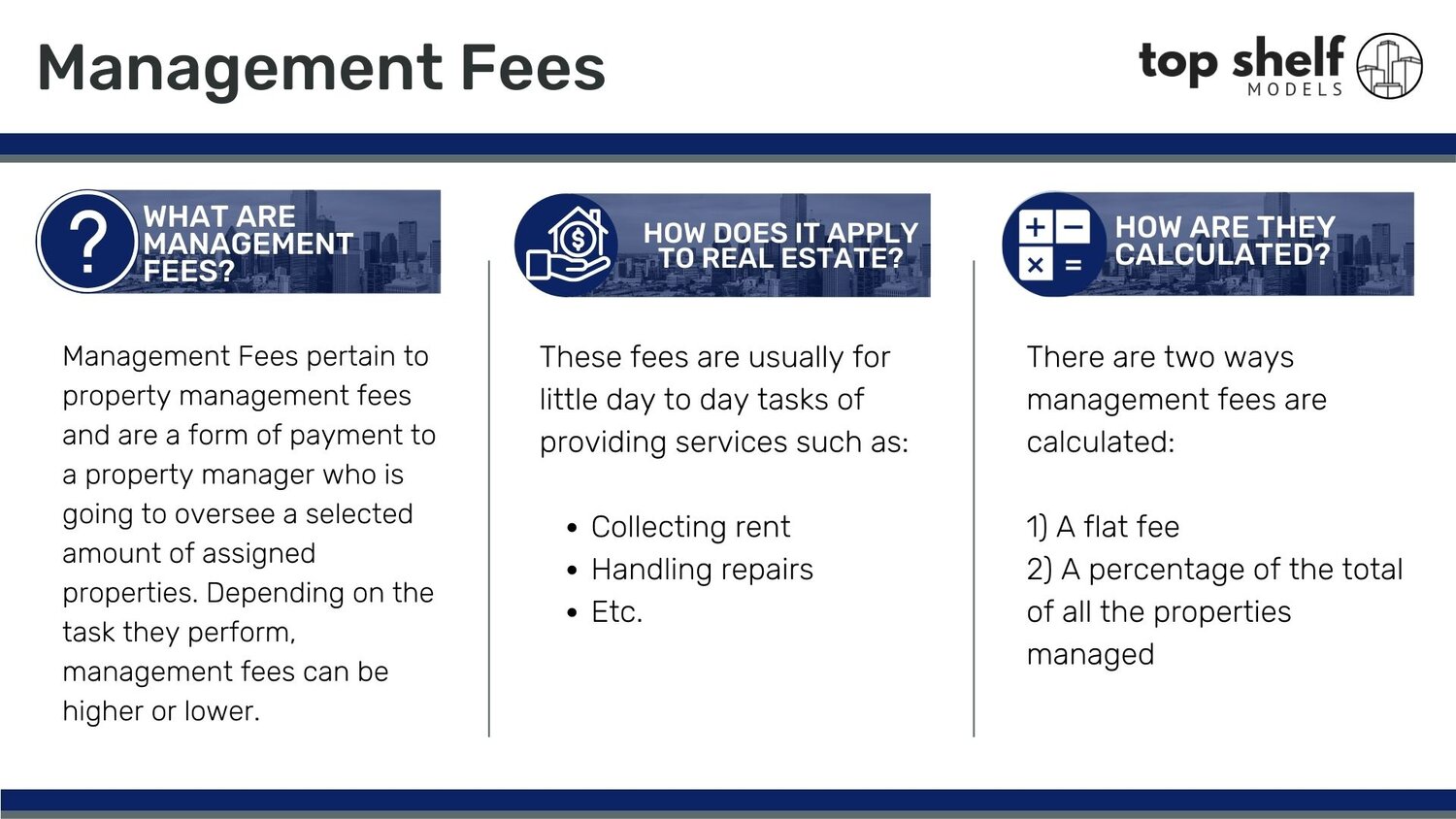

Property Management Fees breakdown. Source: Top Shelf Models

If you decide to rent out your home, property management fees can be incurred for managing tenants and property upkeep. These companies handle day-to-day operations, which can save you time but come with a cost.

- Management Fees: If you rent out the property, property management companies charge fees for handling tenant relations, maintenance, and rent collection.

- Vacancy and Repair Coordination: Property management companies handle tenant vacancy periods and coordinate necessary repairs, ensuring the property is well-maintained and consistently generating rental income. This service saves homeowners time and effort by managing the daily operations and any unexpected issues that may arise.

Interest Rate Adjustments

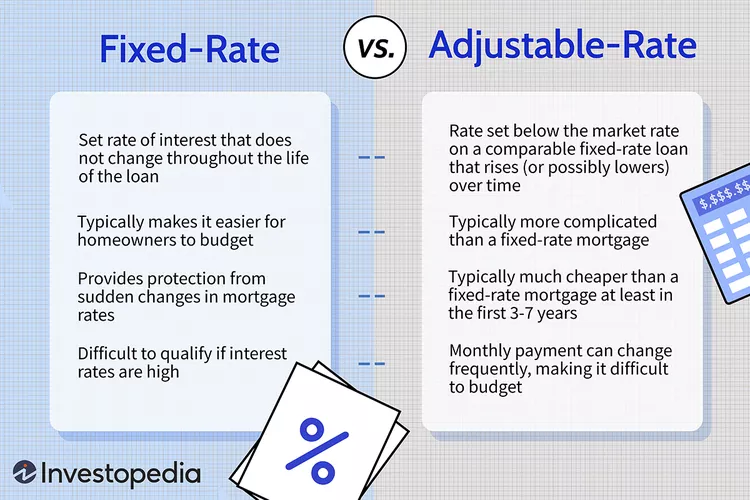

Fixed Rate vs Adjustable Rate Mortgage. Source: investopedia

If you have a variable-rate mortgage, your payments could fluctuate as interest rates change. This can impact your monthly budget, especially during rising interest rates.

- Variable Rates: If you have a variable-rate mortgage, fluctuations in interest rates can impact your monthly payments.

- Fixed-Rate Consideration: Homeowners with variable-rate mortgages may want to consider switching to a fixed-rate mortgage if interest rates are rising, providing more stability in monthly payments. This can help protect your budget from unexpected increases and offer peace of mind for long-term financial planning.

Legal and Administrative Fees

Real Estate Lawyer Fees. Source: Insight Law

Legal and administrative costs often arise when buying or selling a home. These fees can include services like legal advice, property transactions, or record updates with the municipality.

- Legal Costs: Fees for legal services related to property transactions or disputes, and costs for updating records with local authorities.

- Administrative Costs: Updating records and resolving any disputes.

Property Survey

What Is a Land Survey, and When Do You Need One?. Source: The Motley Fool

A property survey is sometimes necessary, especially for new home purchases or when there are boundary disputes. This survey confirms the legal boundaries of your property.

- For New Purchases: A property survey may be necessary to confirm boundaries, especially if the property is new or there are disputes.

- Boundary Clarification: A property survey helps resolve potential disputes with neighbors regarding boundary lines, ensuring you know exactly what land you own. This can prevent conflicts over fences, driveways, or future home improvements that could encroach on neighbouring properties.

Emergency Fund

How much should I save in an emergency fund?. Source: Toronto Star

Setting aside money in an emergency fund is crucial for covering unforeseen expenses. Homeownership can bring unexpected costs, and an emergency fund helps avoid financial strain when they arise.

- Unexpected Expenses: It's wise to have a reserve fund for unforeseen expenses that may arise.

- Regular Contributions: Set aside a portion of your income regularly to build your emergency fund, aiming to cover 3-6 months of living expenses. This will help ensure you can handle unexpected home-related costs without derailing your financial stability.

New Home Warranty

New Home Warranties. Source: CPBH

If you’re buying a newly built home, a warranty may cover any issues that arise within the first few years. Builders of the Manitoba Home Builders Association include this in the purchase price.

- Warranty Premiums: All builders who are members of the Manitoba Home Builders Association carry third-party warranty coverage, which is included in the purchase price of a new home.

- Coverage: New home warranties typically cover major structural defects and issues with electrical, plumbing, and HVAC systems and other home components for a set period. This offers homeowners peace of mind, knowing that their investment is protected against unexpected repairs during the initial years of ownership.

Landscaping and Lawn Care

Lawn Care. Source: Hero Winnipeg

Maintaining a healthy and attractive yard requires ongoing costs for landscaping and lawn care. Depending on the size of the yard and your preferences, this could involve routine tasks or hiring professionals.

- Routine Lawn Care: Regular expenses for mowing, fertilizing, and weeding the lawn.

- Landscaping Projects: Costs for upgrading or maintaining flower beds, trees, shrubs, and hardscaping features like patios and walkways.

Appliance Upkeep and Replacement

New Appliances Source: Premium Solution

Appliances wear out over time, requiring upkeep or eventual replacement. It's important to budget for both routine maintenance and potential replacement costs for major appliances.

- Routine Upkeep: Expenses for servicing appliances like HVAC systems, refrigerators, and dishwashers.

- Replacement Costs: Budgeting for the replacement of aging or broken appliances, such as stoves, washing machines, or water heaters.

Other Potential Hidden Costs

Home ownership comes with several hidden costs that many buyers may not anticipate when budgeting beyond the mortgage. These expenses can add up quickly and should be planned for to avoid surprises.

Here are five more common hidden costs that every homeowner should keep in mind:

- Moving Expenses

- Pest Control

- Homeowners Association (HOA) Fees

- Landscaping Equipment

- Window and Gutter Cleaning

Planning for These Hidden Costs

To avoid unexpected financial strain, it's essential to plan for these hidden costs of homeownership in advance.

Creating a separate budget for these expenses can help you stay prepared throughout the year.

Setting aside funds for routine maintenance and occasional larger expenses will ensure that you are not caught off guard by these additional financial obligations.

By factoring in these costs early, you can maintain and enjoy your home without surprises impacting your long-term financial stability.

3-Step Plan for Managing Hidden Homeownership Costs

Planning for hidden homeownership costs is crucial to avoid unexpected financial strain. By proactively setting aside funds and preparing for routine and unforeseen expenses, you can maintain your home without surprises.

Here’s a simple 3-step plan to help you stay organized and ready for these additional costs.

- Create a Separate Budget

- Prioritize Essential Expenses

- Build an Emergency Fund

Create a Separate Budget

Set aside a portion of your monthly income specifically for home-related costs, such as maintenance, repairs, and unexpected fees. This ensures you're financially prepared throughout the year.

Prioritize Essential Expenses

List the recurring and potential costs, from utilities to maintenance, and prioritize essential services like pest control or lawn care to avoid larger problems down the line.

Build an Emergency Fund

To safeguard your financial stability, establish an emergency fund for unexpected expenses, such as repairs or appliance replacements.

Summary

Owning a home in Winnipeg comes with more than just a mortgage payment. These additional costs, from property taxes and home insurance to utilities, maintenance, and renovations, are essential when budgeting for homeownership.

Understanding and preparing for these expenses, you can better manage your financial responsibilities and avoid surprises.

Whether you’re a first-time homebuyer or looking to invest, having a clear picture of the ongoing costs associated with owning a home will set you up for long-term success.

Planning for these expenses ensures a smoother, less stressful homeownership experience.

If you have any further questions or would like personalized advice on buying a home in Winnipeg, feel free to contact me. I’ll be happy to assist you!

Categories

Recent Posts

Leave a Reply

REALTOR®Thanks for stopping by and taking the time to get to know me!I'm Tara Zacharias, a real estate salesperson and licensed REALTOR® located in the vibrant city of Winnipeg. Real estate and all that's associated with it such as, interior design, construction, community planning, marketing or the financial aspect, all fascinate me. I take pride in working with my clients to find their ideal home, sell their property for the best value and make smart investment decisions.Born in Manitoba, I'm familiar with the prairie life in both the City of Winnipeg or in a rural town, i've lived both. My interests are hiking, riding bicycle, theatre, making art, concerts and trying new restaurants. I have a Bachelor of Fine Arts in drawing and painting and a Post-Graduate Certificate in sculpture and installation from OCADU.Whether you're a first-time homebuyer, a seasoned seller or an investor looking for opportunities, I'm here to guide you every step of the way with integrity, expertise, and a genuine desire to see you succeed in your real estate journey. My mission is to make sure your wants and needs are met so that we can work together again to make your real estate dreams a reality.+1(204) 293-0933 tara@tarazacharias.com

REALTOR®Thanks for stopping by and taking the time to get to know me!I'm Tara Zacharias, a real estate salesperson and licensed REALTOR® located in the vibrant city of Winnipeg. Real estate and all that's associated with it such as, interior design, construction, community planning, marketing or the financial aspect, all fascinate me. I take pride in working with my clients to find their ideal home, sell their property for the best value and make smart investment decisions.Born in Manitoba, I'm familiar with the prairie life in both the City of Winnipeg or in a rural town, i've lived both. My interests are hiking, riding bicycle, theatre, making art, concerts and trying new restaurants. I have a Bachelor of Fine Arts in drawing and painting and a Post-Graduate Certificate in sculpture and installation from OCADU.Whether you're a first-time homebuyer, a seasoned seller or an investor looking for opportunities, I'm here to guide you every step of the way with integrity, expertise, and a genuine desire to see you succeed in your real estate journey. My mission is to make sure your wants and needs are met so that we can work together again to make your real estate dreams a reality.+1(204) 293-0933 tara@tarazacharias.com330 St Mary Ave, Winnipeg, MB, R3C 3Z5, CAN

https://tarazacharias.com/