List First or Buy First?

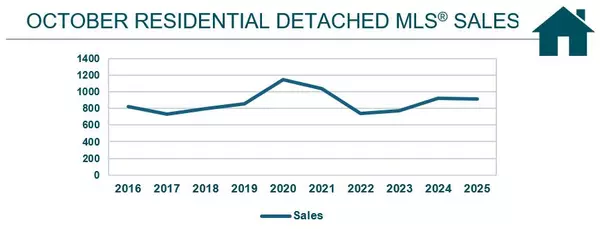

1. Understanding the Market Conditions

The first thing to assess is whether it’s a buyer's or seller's market in your area. In a seller's market, homes tend to sell quickly, which can be beneficial if you’re listing your home. But finding your next home could be a challenge.

On the flip side, in a buyer’s market, you may have more difficulty selling, but you’ll have a wider selection of homes to choose from. Understanding the local market, especially in Winnipeg, will help you make informed decisions about timing.

2. Plan with a Realistic Timeline

It’s common to sell and buy a home at the same time, but it’s important to plan out the process so you know what to expect:

- Prepare your home for sale while beginning your new home search.

- On average, the process from listing to closing can take 2-3 months, but it depends on your local market and property condition.

- You should consider lining up a sale contingency clause if you're purchasing a home contingent on the sale of your current one, or vice versa, to protect yourself from ending up with two homes or none at all.

3. Work with a REALTOR®

A REALTOR® can help you navigate the process by evaluating market trends, negotiating terms, and coordinating the sale and purchase to meet your specific needs.

Timing can be unpredictable, but a professional can help you maximize your home’s value and ensure you don’t miss out on opportunities for your next home.

Short-Term Financing: If the Sale and Purchase Don't Align Perfectly

If your equity is tied up in your current home and you haven't sold it yet, short-term financing provides the funds needed for a down payment on your new home. This allows you to secure a property without waiting for the sale proceeds from your current home.

Financial Planning

-

- Review your financial situation with a financial advisor to determine the best approach. If owning two homes temporarily by using short-term financing, you’ll need sufficient income to manage both mortgage payments.

Borrow your Down Payment

Consider a personal loan for the down payment from family or friends.

Ask your bank for an unsecured personal loan, which doesnt put your current home at risk.

Use the equity in your current home through a Home Equity Line of Credit (HELOC) to obtain a down payment to buy the other home. This could be a second priority mortage. Not all lendors may allow this, so you may have to check with other lendors.

Obtain a Bridge Loan

If necessary, you can get a short-term loan from a bank or financial institution to cover the gap between purchasing your new home and selling your old one.

This involves taking out a home equity loan on your existing property, which you repay once your old home sells. Be aware that bridge loans can be costly, with higher interest rates, and are typically only available for up to six months.

Reverse Mortgage

-

- If you’re 62 or older, a reverse mortgage might allow you to access the equity in your current home to help with the purchase of your new one. In Canada, you can borrow up to 55% against your home value if you're 62 and older. Reverse Mortgage lets you borrow against the value of your home.

Benefits of Short-Term Financing

Flexible Repayment Terms

Many short-term financing options, like bridge loans, have flexible terms. They’re designed to be paid off quickly once your home is sold. This temporary financial solution helps you avoid taking on a long-term mortgage or more permanent financing when you only need short-term liquidity.

Avoiding a Double Move

Instead of selling your home, moving to temporary housing, and then moving again once you buy a new property, short-term financing lets you move directly from one home to the next. This can save time, reduce stress, and minimize costs related to storage and temporary accommodations.

Taking Advantage of Market Opportunities

The real estate market moves quickly, especially in competitive areas. If you find a home you love, short-term financing allows you to act fast and make an offer without waiting for your current home to sell. This can be particularly helpful in a seller’s market where homes can be sold at a quicker rate.

Maximizing the Sale of Your Current Home

Using short-term financing gives you more flexibility when selling your home. Instead of rushing the sale because you need the funds to buy your next home, you can take your time to get the best possible offer. This is especially helpful if the market conditions for selling aren't ideal.

Easier Transition Between Homes

With short-term financing, you can schedule the purchase of your new home and the sale of your current home without being bound to aligning closing dates perfectly. This gives you more freedom to handle the logistics of moving and settling into your new place.

Bridging the Gap: For Timing That Isn't Perfect

Even with the best planning, there’s a chance the timing won’t be perfect. Be prepared for a gap in between selling your current home and buying your next one.

You might need temporary housing—whether it's staying with family, short-term rentals, or even negotiating a rent-back agreement (where you sell your home but rent it from the buyer for a short time). This gives you a buffer if the two transactions don’t line up exactly. You may considor:

Temporary Housing:

- Short-Term Rentals: Explore options for month-to-month rentals or furnished apartments to temporarily accommodate you between homes.

- Stay with Friends or Family: If feasible, staying with loved ones can be a practical and cost-effective solution.

Leaseback Agreements:

-

- Negotiate a Leaseback: If your buyer agrees, you might rent your current home from them for a short period post-sale, giving you extra time to find your next home.

Sell First, Buy Later:

-

- Prioritize Selling: Selling your current home first can simplify the process, especially if you have arrangements for temporary housing or financing.

Contingency Offers:

-

- Include a Sale Contingency: When making an offer on a new home, consider adding a contingency that the purchase depends on selling your current home. This can make your offer less attractive but provides some security.

Negotiate with The Seller:

-

- Seek Flexibility: Try to negotiate with the seller of your new home for a delayed closing or settlement date. They might be open to allowing you to stay longer in your current home or extend the closing period.

Coordinate Closing Dates

The goal is to align the closing dates of both properties to make the transition as seamless as possible. If possible, aim to sell your home first with an extended closing period (for instance, 60 to 90 days).

During this time, you can search for your next home and schedule the closing date of your purchase shortly after the sale is finalized. Flexibility in negotiation is crucial for this.

Summary

Categories

Recent Posts

Leave a Reply

REALTOR®

REALTOR®I became a REALTOR® because I truly enjoy helping people find the place that feels like home and because providing exceptional service during such an important moment in someone’s life is something I genuinely care about. Supporting sellers as they move on, move up, or move forward is just as meaningful, and being part of that transition is something I’m grateful to contribute to.

I make the buying or selling journey feel organized and approachable with clear communication and practical guidance. With an approach supported by market data, trends, and neighbourhood insights, you'll always understand what’s happening and how to make the most informed decisions.

Whether you’re buying your first home, selling a place filled with memories, or planning your next step, I’m here as someone who listens, shows up, and puts your goals at the centre of every decision. I'm focused on what serves you best.

I'm Tara Zacharias, a real estate salesperson located in the vibrant city of Winnipeg. Thanks for stopping by and taking the time to get to know me!+1(204) 293-0933 tara@tarazacharias.com330 St Mary Ave, Winnipeg, MB, R3C 3Z5, CAN

https://tarazacharias.com/