Why Market Stats Matter in Any Market

No matter the conditions—seller’s, buyer’s, or balanced—understanding key real estate statistics available from Winnipeg Regional Real Estate Board or your REALTOR® is essential. Metrics such as average home price, price per square foot, days on market, the sales-to-listing ratio, and year-over-year changes give buyers and sellers critical insight into how the market is behaving and what to expect.

Average Home Price

Average price gives a snapshot of what homes are selling for in the current environment. It helps buyers understand affordability and helps sellers determine realistic expectations. Rising or falling averages can also signal shifts in demand.

Price Per Square Foot

Price per square foot provides a more precise measure of value, especially when comparing homes of different sizes or styles.

This metric often reveals trends that average price alone can hide, especially in areas where home sizes vary widely.

Days on Market (DOM)

DOM indicates how quickly homes are selling:

-

Low DOM → Strong demand, fast-paced market

-

High DOM → Slower demand, more negotiation room

It helps buyers gauge competition and helps sellers understand how long selling might realistically take.

Sales-to-Listing (SLR) Ratio

The SLR ratio shows the balance between supply and demand. It is a key real estate metric that compares the number of homes sold in a given period to the number of new listings that came to market during the same time.

It is one of the most important indicators used to determine whether the market favors buyers, sellers, or is balanced.

How It’s Calculated

Sales-to-Listings Ratio = (Number of Sales ÷ Number of New Listings) × 100

Example:

If 600 homes sold and 1,000 homes were listed, the ratio is:

(600 ÷ 1,000) × 100 = 60%

-

Above 60% → Seller’s market, there are more buyers than available homes.

-

40–60% → Balanced, supply and demand are relatively equal.

-

Below 40% → Buyer’s market, there are more homes available than active buyers.

This is one of the clearest indicators of who has the advantage in negotiations.

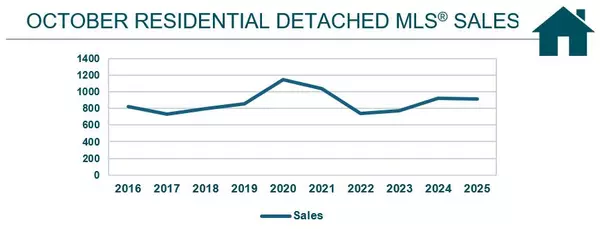

Year-Over-Year Gains or Declines

Year-over-year (YOY) data reveals longer-term trends,

This helps buyers understand appreciation potential and helps sellers time their listing for maximum return.

Putting It All Together

When combined, these statistics create a clear picture of the market’s temperature, momentum, and direction. They show how much homes are worth, how fast they’re selling, how competitive conditions are, and whether values are rising or falling over time.

Whether you're entering the market to buy, planning to sell, or simply monitoring local trends, understanding these core metrics empowers you to make smart, strategic decisions—no matter what type of market you’re in.

Not a Statistic but Relevent

Market Value

Market value reflects what a home is truly worth based on current conditions—not just what it’s listed for. Market value is not a statistic, rather, it is a price determined by the homes condition/upgrades, location, property type/size/features and is influenced by buyer demand/willingness to pay, market forces, comparable sales from neighboring properties and economic stability. Understanding market value ensures buyers don’t overpay and sellers don’t underprice.

Final Thoughts

Deciding whether to buy or sell in a seller’s, buyer’s, or balanced market is more than a timing decision — it’s a strategy. Each type of market brings its own opportunities, challenges, and leverage points, and understanding the conditions you’re stepping into can help you make choices that align with your goals.

While it’s almost always beneficial to enter the market as soon as you’re financially ready — so you can begin building equity and securing long-term stability — choosing how and when to buy or sell within the current market landscape can make a meaningful difference. The right market can offer you more negotiating power, stronger pricing outcomes, or a smoother path to your next home.

No matter the conditions, an informed approach gives you clarity, confidence, and the ability to maximize your position. With the right guidance and a clear understanding of market dynamics, you can make decisions that support both your financial future and your lifestyle needs.

REALTOR®

REALTOR®