Real Estate Market Statistics around Winnipeg and Surrounding Areas for November 2025

Winnipeg Real Estate Market Statistics for November 2025

The Winnipeg Regional Real Estate Board’s November 2025 market release reveals a year marked by strong cumulative performance—despite a noticeably slower November. Year-to-date (YTD) sales, prices, and dollar volume all show healthy growth, even as November reflects the expected seasonal slowdown intensified by shifting buyer behavior.

While November was softer across most categories, the overall 2025 market remains one of the strongest on record, displaying remarkable resilience.

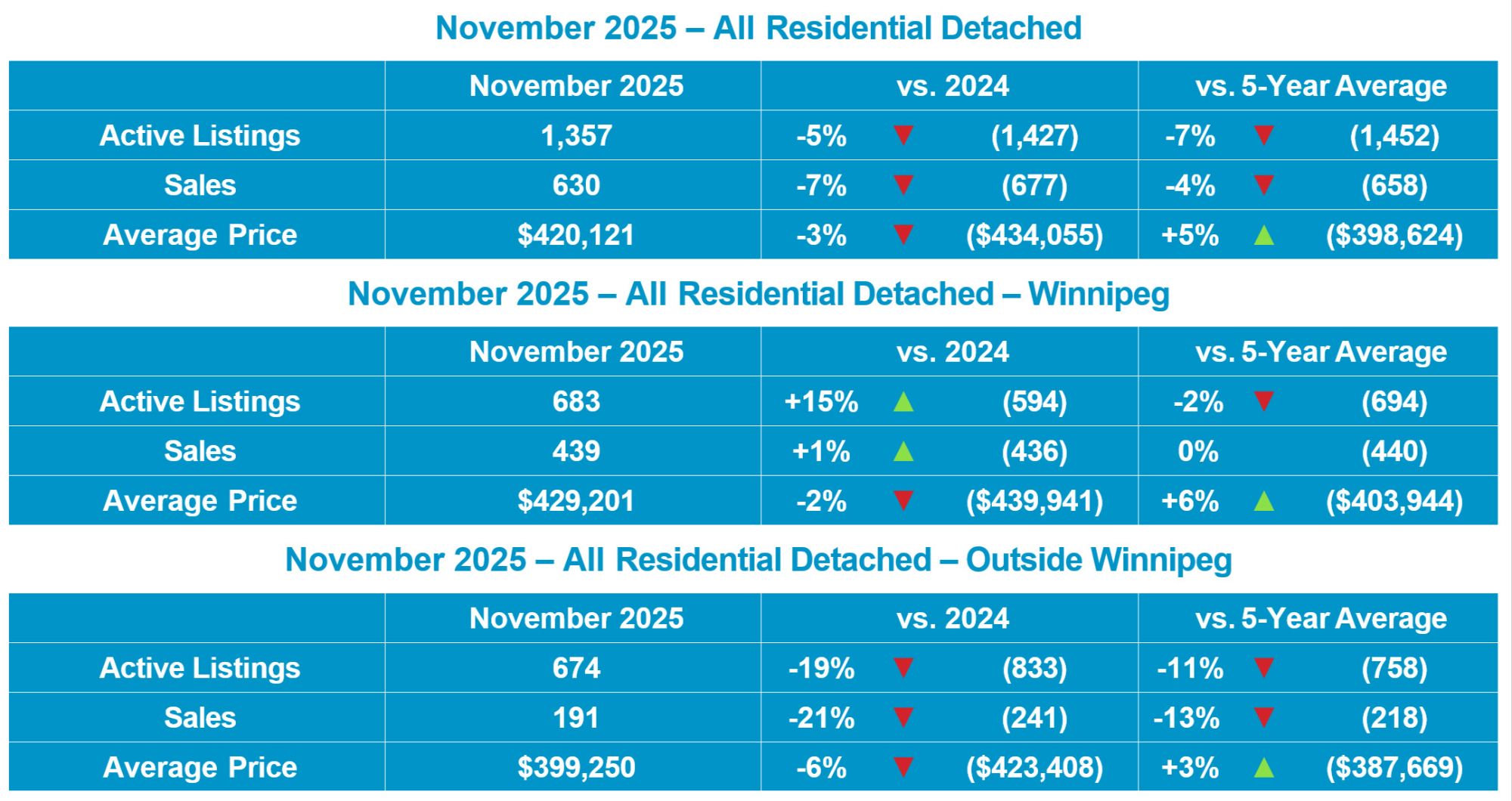

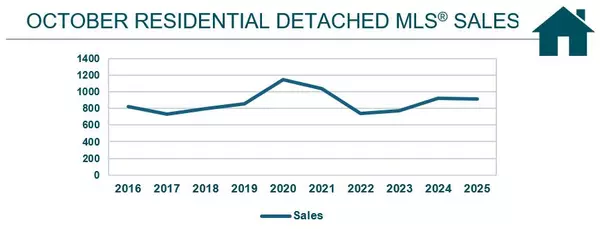

Residential Detached Market Analysis

Residential detached homes remain the largest segment of the MLS® system, and the data tells a two-sided story: strong year-to-date momentum but a cooling November.

Year-to-Date Highlights

-

Detached YTD sales: 9,842 (up 3%)

-

Average YTD price: $451,137 (up 6%) – a new November record

This confirms that detached homes continue to anchor the market, with prices climbing steadily through most of 2025.

November Snapshot vs. 2024

-

Sales down 7% (630 detached sales)

-

Average price down 3% ($420,121)

-

Dollar volume declined, reflecting fewer higher-priced sales

This is notable because, as WRREB President Michael Froese stated:

“This is the first month in 2025 when residential detached average prices declined versus 2024 and did not set a monthly average price record.”

In other words, the November softening is not a downturn—it’s a deviation from an otherwise record-setting year.

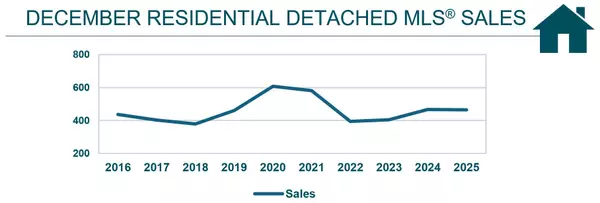

Trend Interpretation

The longer-range detached sales chart (2016–2025) shows November 2025 settling back into pre-pandemic norms after major spikes in 2020–2021. The market is recalibrating, not retracting.

Winnipeg vs. Outside Winnipeg

-

Winnipeg sees slight sales growth Y/Y and a modest price dip.

-

Outside Winnipeg sees steeper sales declines and deeper price reductions.

This further confirms the urban market’s stability compared to more volatility in rural regions.

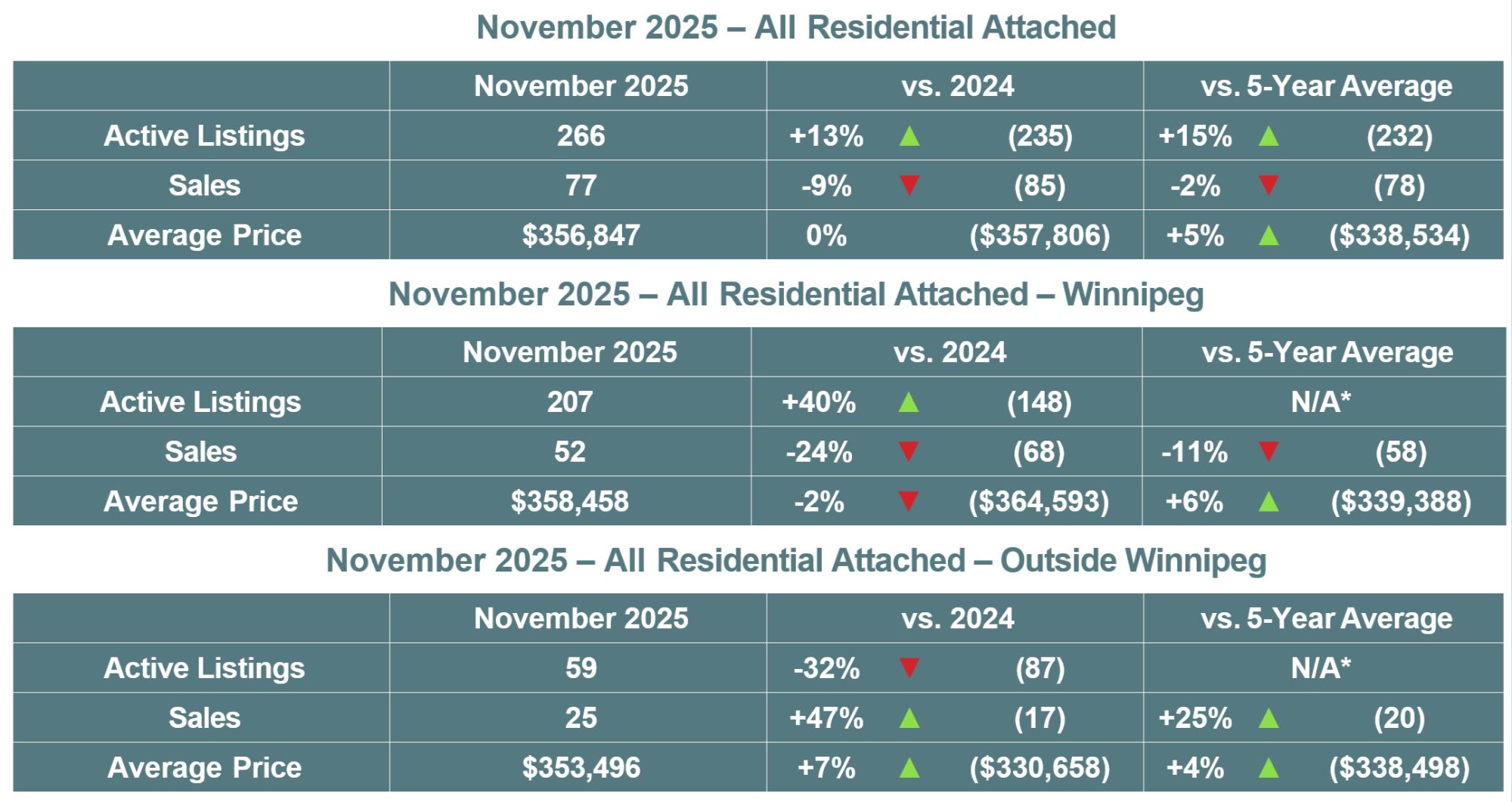

Residential Attached Market Analysis

Attached homes—townhouses, duplexes, and semi-detached—show the widest variation between Winnipeg and surrounding regions.

Market Movement

-

Listings up 13% (more sellers entering the market)

-

Sales down 9% (buyers more cautious)

-

Average price flat year-over-year

Winnipeg vs. Outside Winnipeg

Winnipeg Attached Market

-

Listings up 40%, but sales down 24%

-

Prices down only 2%, showing stability despite buyer hesitation

This suggests inventory is rising faster than demand—buyers have choice, and sellers must price competitively.

Outside Winnipeg Attached Market

-

Listings down 32%, yet sales up 47%

-

Prices up 7%, driven by limited supply and affordability appeal

The disparity reflects a shift toward smaller, budget-friendly properties—particularly in commuter towns where detached home affordability has eroded.

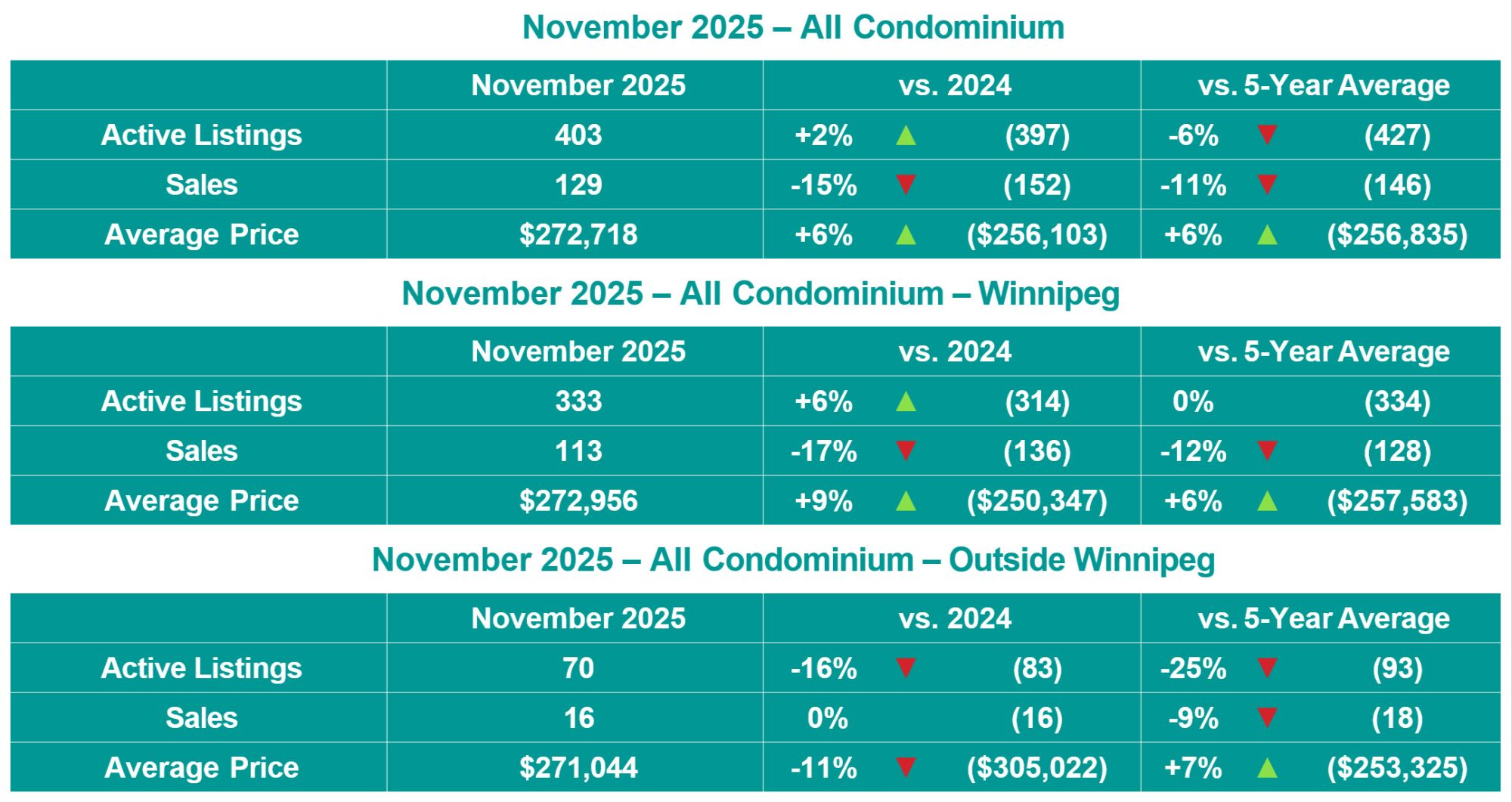

Condominium Market Analysis

Condominiums continue to play an increasingly important role in affordability and urban housing diversity.

Year-to-Date Strength

-

Condo YTD sales: 2,070 – statistically even with 2024

-

Average YTD price: $283,498 – up 3% and a new November record

Despite flat sales, condo pricing power is clearly rising, suggesting a demand for modern, well-located units and a growing share of first-time buyers.

November Snapshot

-

Sales down 15% (129 sales)

-

Average price up 6% ($272,718)

The November price increase amid falling sales indicates that higher-quality or newer developments continue to outperform older inventory.

Market Interpretation

Condos are the most resilient property category this November, with rising prices and relatively stable year-to-date demand. As detached prices climbed earlier in the year, condos captured a wave of interest from buyers seeking attainable ownership options.

All MLS® Overview – One of the Strongest Years on Record

The broader MLS® market shows impressive strength for 2025 overall, even though November itself slowed down.

Year-to-Date Performance (Jan–Nov 2025)

-

Sales: 14,431 – up 4%

-

Listings: 21,996 – unchanged from 2024

-

Dollar Volume: $5.7B – up 10%

The fact that the market achieved the third-highest YTD sales and second-highest dollar volume on record underscores remarkable demand despite higher interest rates and general economic uncertainty.

November vs. 2024

-

Sales down 10%

-

Dollar volume down 12%

-

Active listings down 5%

This cooling aligns with seasonal expectations but is slightly more pronounced due to buyers awaiting rate cuts and more inventory.

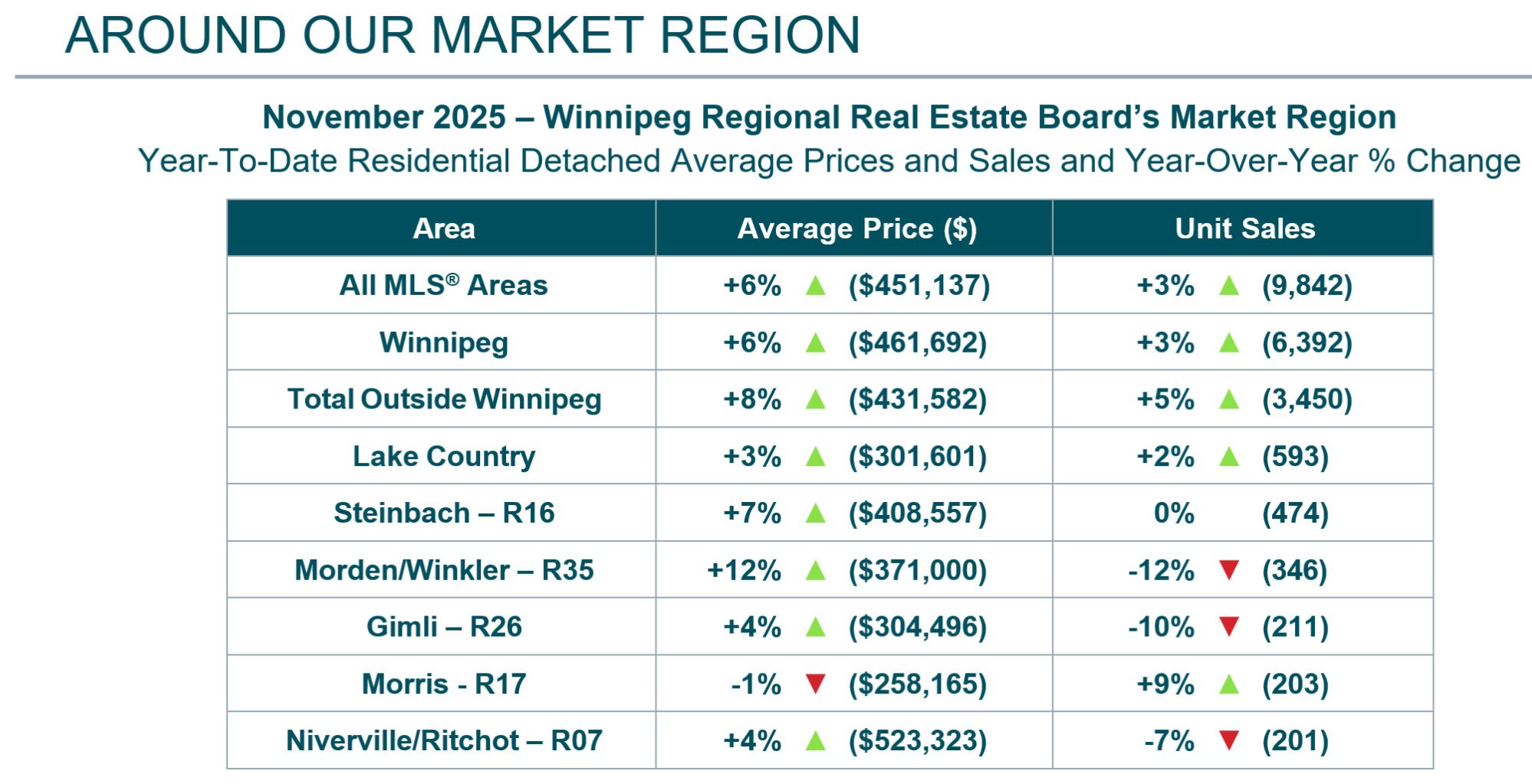

Regional Market Breakdown – Where Prices Rose and Fell

The regional data reveals just how differently each part of Manitoba performed in 2025.

Top Price Growth Markets

-

Morden/Winkler: +12%

-

Steinbach: +7%

-

Total Outside Winnipeg: +8%

-

Niverville/Ritchot: +4%

These areas continue to attract families, newcomers, and remote workers seeking value without sacrificing amenities.

Flat or Declining Markets

-

Morris: –1% price decrease but +9% sales growth

-

Gimli: –10% sales despite a 4% price increase

Some regions are experiencing transitions—new builds, demographic shifts, or affordability ceilings impacting sales pace.

Winnipeg’s Market

-

Average price: $461,692 (+6%)

-

Sales: +3%

Winnipeg remains a steady, balanced anchor in the provincial market with consistent year-to-year performance.

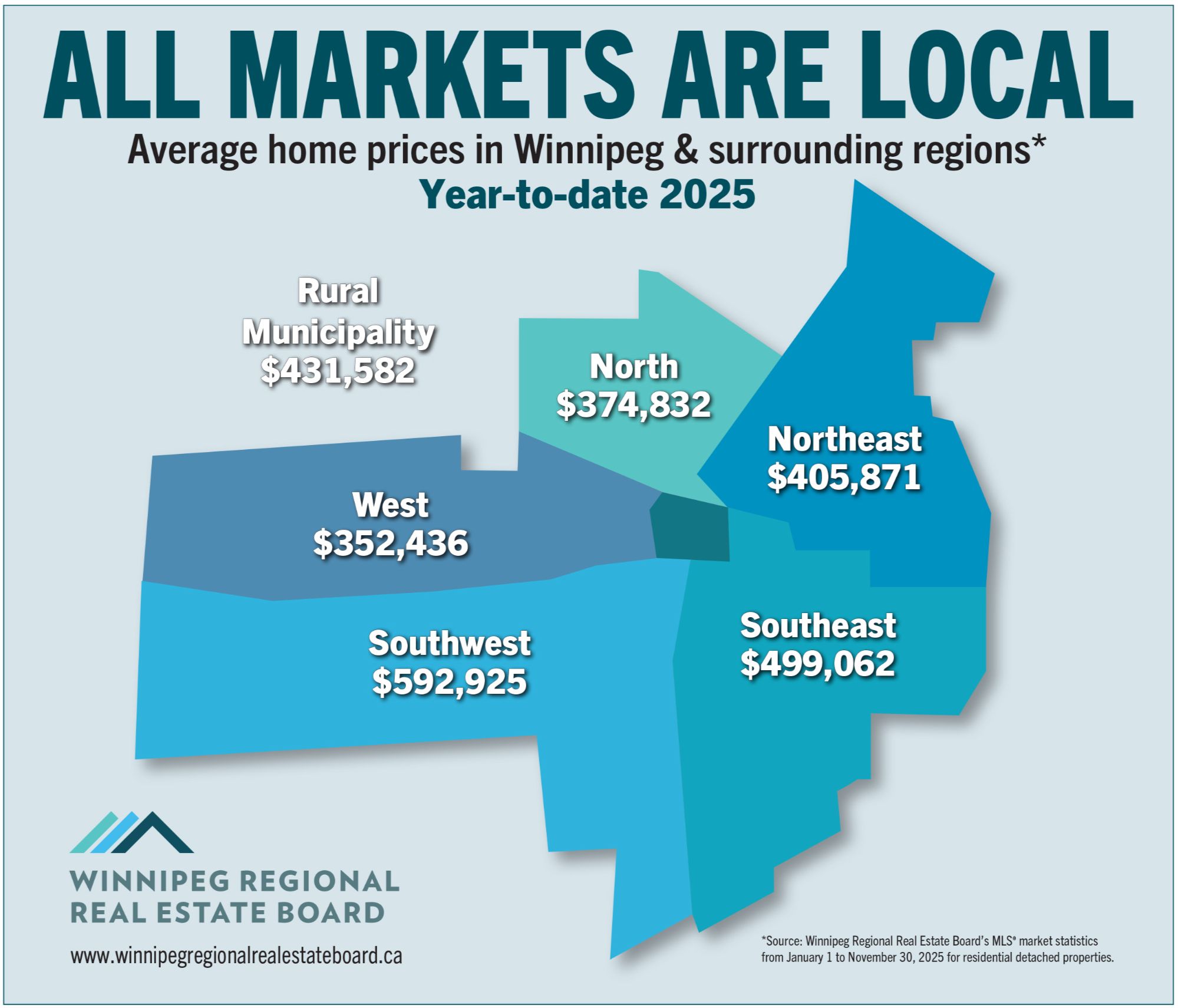

Winnipeg Neighborhood Breakdown

-

Southwest Winnipeg leads with a striking $592,925 average—reflecting premium neighborhoods and newer developments.

-

Southeast Winnipeg follows at $499,062.

-

North Winnipeg remains the most affordable at $374,832.

Affordability gaps between regions could encourage migration toward more accessible submarkets, particularly among first-time buyers.

Final Thoughts - A Market Balancing Strength and Transition

2025 remains one of the strongest years in Manitoba real estate history—supported by,

-

Record or near-record prices in key categories

-

Healthy year-over-year sales and dollar volume growth

-

A shift toward balanced market conditions after several overheated years

For Sellers

-

Detached homes may require sharper pricing strategies—especially outside Winnipeg.

-

Attached homes in Winnipeg face more inventory competition.

-

Condo sellers benefit from rising values in the city.

For Buyers

-

More listings mean more choice.

-

Negotiating power has increased in several segments.

-

Condos and rural attached homes offer strong value opportunities.

Buyers are more deliberate. Sellers face more competition. Price growth is moderating.

Tara Zacharias, REALTOR®

Categories

Recent Posts

Leave a Reply

REALTOR®

REALTOR®I became a REALTOR® because I truly enjoy helping people find the place that feels like home and because providing exceptional service during such an important moment in someone’s life is something I genuinely care about. Supporting sellers as they move on, move up, or move forward is just as meaningful, and being part of that transition is something I’m grateful to contribute to.

I make the buying or selling journey feel organized and approachable with clear communication and practical guidance. With an approach supported by market data, trends, and neighbourhood insights, you'll always understand what’s happening and how to make the most informed decisions.

Whether you’re buying your first home, selling a place filled with memories, or planning your next step, I’m here as someone who listens, shows up, and puts your goals at the centre of every decision. I'm focused on what serves you best.

I'm Tara Zacharias, a real estate salesperson located in the vibrant city of Winnipeg. Thanks for stopping by and taking the time to get to know me!+1(204) 293-0933 tara@tarazacharias.com330 St Mary Ave, Winnipeg, MB, R3C 3Z5, CAN

https://tarazacharias.com/